Can You Quantify a University’s Return on Investment?

What’s the second most expensive purchase you’ll make in your lifetime after purchasing your home? You guessed it – a college education. CNBC estimates that tuition for private, four-year colleges has more than doubled in the past 20 years, whereas public, four-year college tuition mas more than tripled.

Given rising tuition costs and massive amounts of student loan debt – labeled by Forbes as a “$1.5 Trillion Crisis” and confirmed by CareersWiki– it’s no wonder that students and families need to carefully weigh their options and find the colleges that will provide the best return on investment. A new study from Georgetown University, A First Try at ROI: Ranking 4,500 Colleges attempts to do just that, by calculating the net present value of college and university costs 10, 15, 20, 30, and 40 years forward.

Net present value operates on the principle that an investment has a present value today that can be calculated when cash flows – both positive and negative – along with the timeframe of the investment are considered. Traditionally used for calculating the financial viability of long term projects and capital expenditures, the researchers applied this model to the college and university model, utilizing publicly available information on the U.S. Department of Education’s College Scorecard such as net price and median earnings.

The analysis revealed several interesting generalities and trends regarding the institution type and its return on investment. In the short term (10 years), community colleges and certificate programs have the highest returns on investment. However, over a longer-term window (40 years), four-year colleges that award Bachelor’s degrees have the highest long term return on investment. The study also revealed that while public colleges have higher returns on investment in the short term, long term return on investment calculations showed that private, non-profit colleges provide the best economic value.

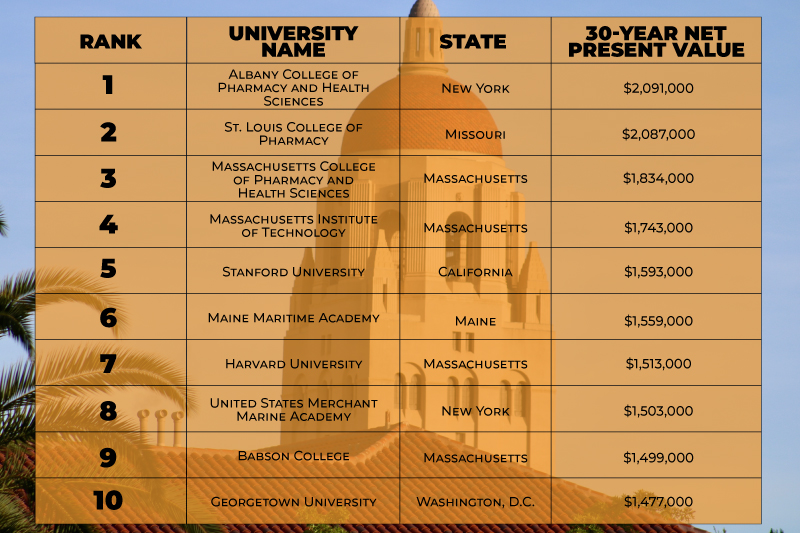

The rankings of colleges and universities, sorted by the highest 30-year net present value, are shown in the table below. Among the top 10 are prestigious universities that one might expect, such as Harvard University, Stanford University, and the Massachusetts Institute of Technology. However, several smaller and perhaps relatively unknown colleges offering degrees in pharmacy and the health sciences have some of the highest economic value. These findings suggest that in addition to higher reputation private colleges, there are likely a number of lesser-known colleges offering degrees in specialized fields that provide a reasonable return on investment.

Although the study made several assumptions that might raise some level of question (such as not including financial aid students receive and assuming a 2% interest rate in net present value calculations), the findings nevertheless continue to recognize and reinforce the notion that college, despite its increasingly high sticker price, is worth the investment in the long run.

This article is available and can be accessed in Spanish here.